FutureSim(TM) manages the complete war gaming and stress testing scenario lifecycle.

(TM)

(TM)

FutureSim(TM) manages the complete war gaming and stress testing scenario lifecycle.

(TM) (TM)

|

||

|

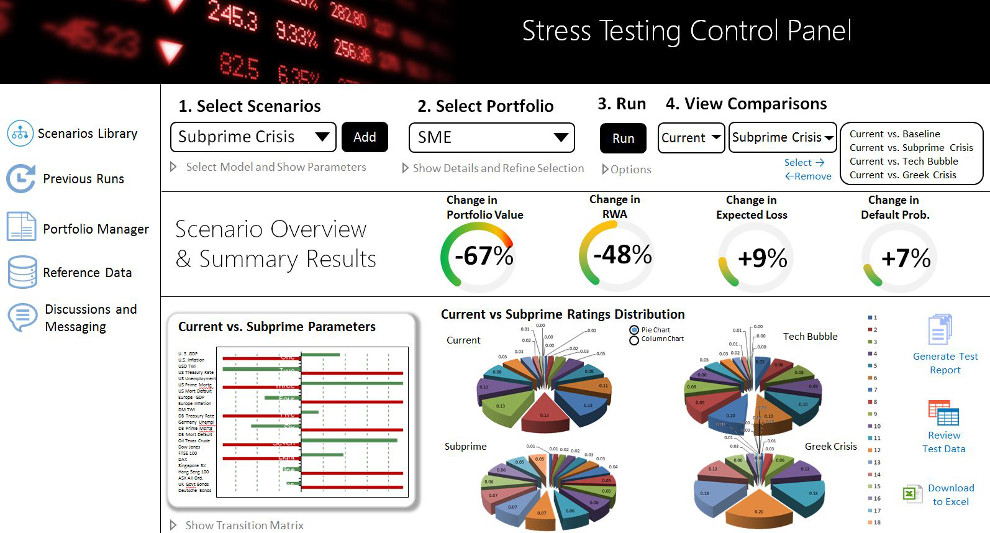

Whether it is Regulatory Stress Tests or Business Driven Scenarios, FutureSim™ simulates possible futures of even the most complex portfolios.

Click to enlarge

It inherits all the agility and service-based paradigm from the RFM suite and can seamlessly integrate CreditRate™

and the other products in the RFM suite to provide a striking uplift the of the risk management culture of commercial lending to another plane

altogether. For the first time, financial institutions can take advantage of robust, flexible war gaming style scenario authoring and simulation

capability ready for a situation room, to extract practical outcomes from a stress test with all the relevant expertise in the room.

No more PowerPoint presentations, quants recutting the numbers weeks later, and expertise going “cold” in the meantime.

Gamification of Commercial Stress Testing

Stress Testing is the cornerstone of lending and investing in general.

However due to the many skillsets required this has not developed into the powerful activity that it is in other spheres of risk management.

RFM has re-imagined what stress testing should be and we have used the War Gaming situation room as our archetype,

where the various different skill sets converge with powerful and agile technologies to plan out many contingencies and future

outcomes. FutureSim™ has all the building blocks to set up scenarios, simulate them and observe portfolio and balance sheet

outcomes. Expert correction to the statistical and other quantitative approaches can be performed on-the-fly and the change

to the portfolio and balance sheet accessed. This provides powerful and immediate feedback and bolsters a risk-culture where everyone

is always looking over the horizon for any emergent risk and which driver may be affected.

How FutureSim™ transforms the risk-culture of commercial loan management

Cultural transformation of risk management is about having the capability to simulate the future of a portfolio,

business segment, geography and ultimately balance sheet through scenarios war-game style interaction, and then

take action to henge and mitigate risks in a timely manner. Most ris managers would agree withis but until RFM’s FutureSim™

these risk-culture defining activities have been only performed in small propriety trading teams. RFM wasn’t to extend the

ability to commercial and retail lending in banks to give banking executives the ability to frame and lead the debate once more

on where the real future stresses are, rather than wait for reactive macro prudential feedback that can be damaging to growth.

Importantly, the agility technologies RFM brings, transform credit risk management from a prudential oversight requirement to a

powerful strategic tool. In today's dynamic, rapidly diversifying, and increasingly competitive market, acting faster and

smarter, and with better information, will separate the lenders who thrive in new, technology-driven environments from those who

fail to modernize and fall by the wayside.

|

|

Risk Framework Manager

|

|

PRODUCTS & SERVICES

SUPPORT

COMPANY

EVENTS & MEDIA

THOUGHT LEADERSHIP

|

Please send me more information

OK to call me

|

Copyright © 2018 RFM