(TM)

(TM)

RFM CreditRate(TM) delivers streamlined and accurate commercial credit rating

that quickly and frictionlessly adapts to changing risks.

(TM) (TM)

|

||

|

Commercial credit rating with retail lending efficiency

|

||||||||||||||||||||||

|

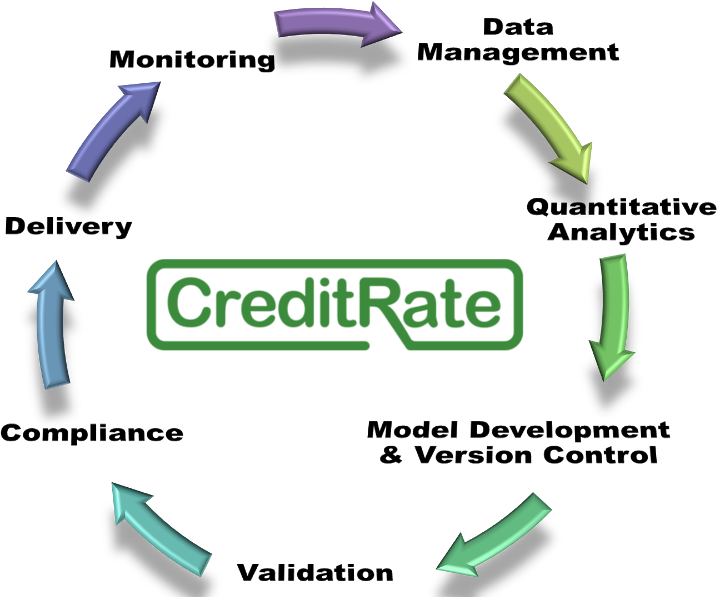

A complete solution for the commercial credit risk life-cycle

| ||||||||||||||||||||||

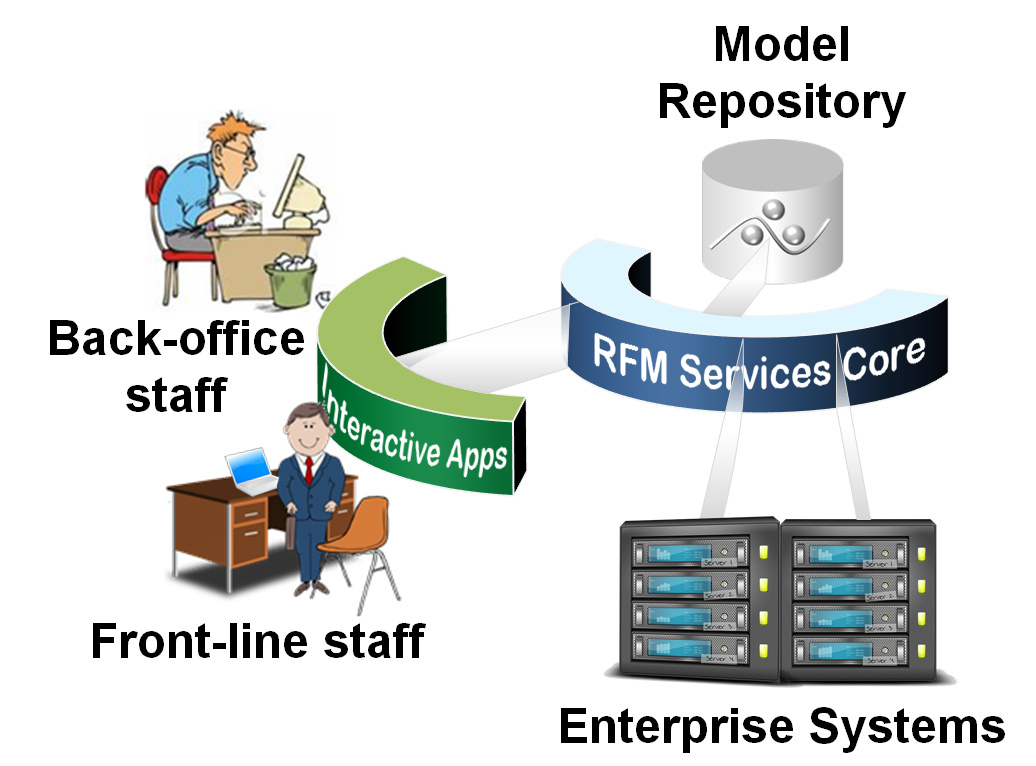

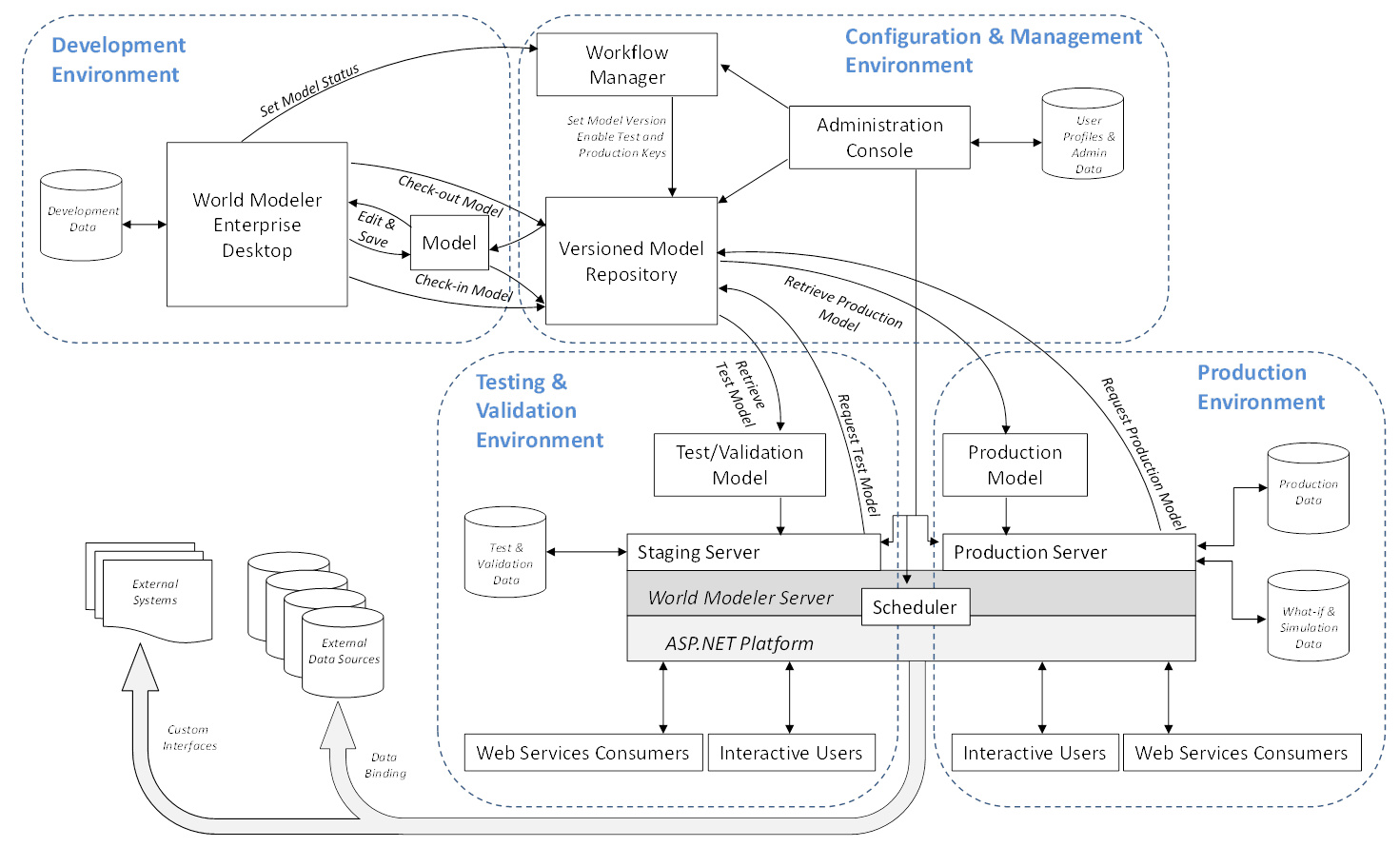

Credit rating as a service

CreditRate(TM) is built on the RFM Core Framework following a service-oriented approach. That is, the CreditRate(TM) server exposes a number of Web Services that "consumer" applications anywhere in the enterprise can invoke. For example, if a loan origination system, of a system that oversees and reports on overall portfolio risk needs a Probability of Default (PD) calculation, or a credit rating, etc. it just invokes a CreditRate(TM) Web Service that will load the appropriate model, feed in the data supplied by the caller, and calculate the required result. Because models and related calculations are separated from systems that consume these by the services layer, both models and consumer systems can be updated independently without any changes to the unaffected system. The CreditRate(TM) service provider technology can be deployed on premise, and models maanaged by your existing team, or RFM's credit risk analysts can perform this service on your behalf. Alternatively, RFM can host the CreditRate(TM) service and manage all aspects of its operation, including monitoring and annual maintenance of the models.

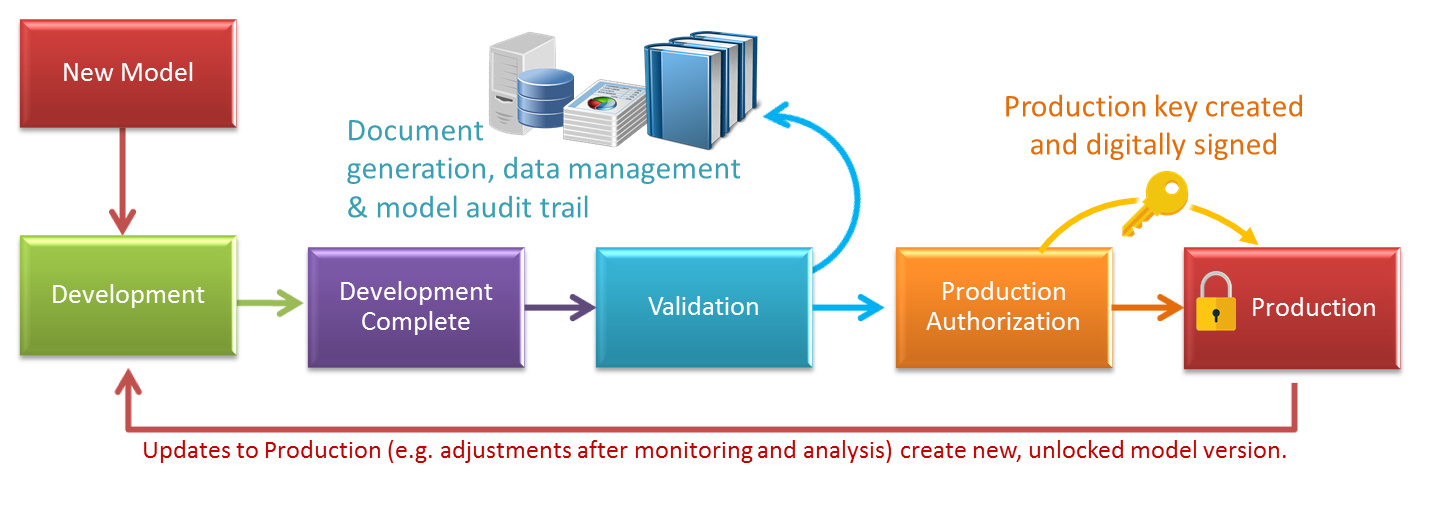

Secure version and access control, workflow, and document automation

CreditRate(TM) stores models and associated resources, such as source data sets, analyses, discussion histories, etc. all in a single place. If RFM's's FutureSim(TM) is used, simulation runs are also stored. So as well as providing secure storage for current and historical models, RFM's model repository will also become your organization's institutional momory.

Secure enterprise repository.

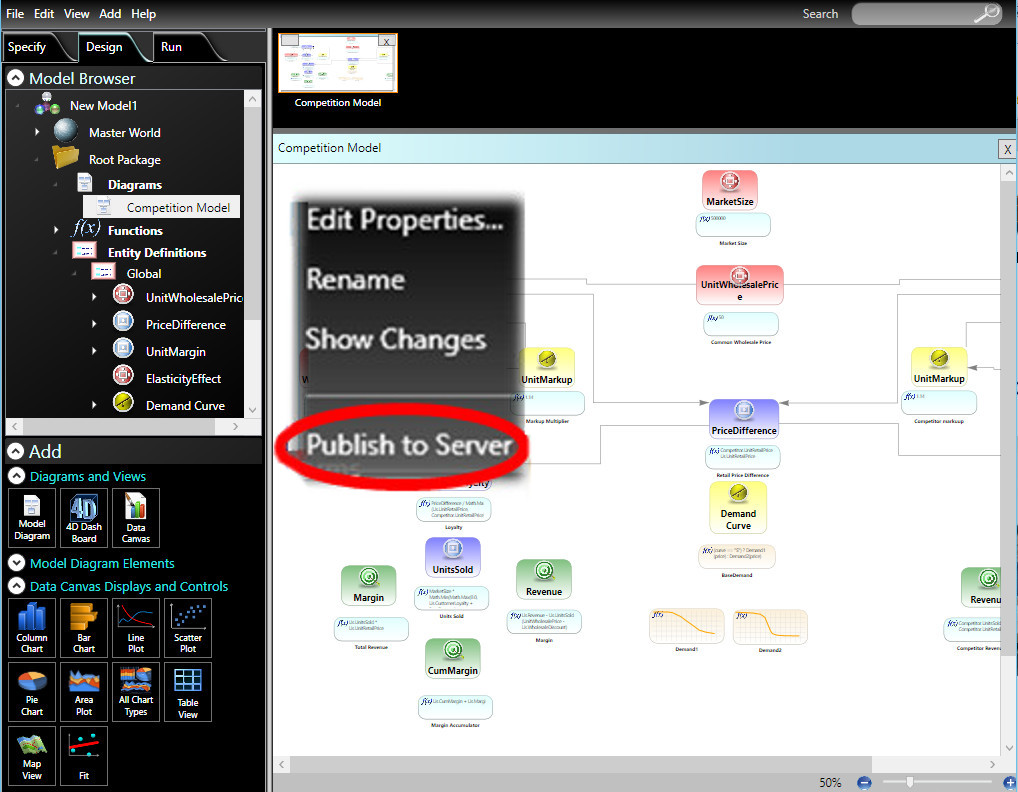

Visual modeler with multi-language support and dynamic data binding

For the modeler, an intuitive graphical interface is provided. This can either be used to create models natively using the in-built support for the C# and R languages, or integrate any other modeling platform that offers a .NET interface (e.g. Python, MatLab, F#, SAS, etc.). The modeler is fully integrated with the repository and production servers, making model workflow and deployment to production a "one-click" operation and slashing months from typical deployment cycles. The modeler accesses the full mathematical power of the R language, the Math.NET library, and allows analysts to create custom function libraries. Excel spreadsheets can also be integrated, and their data read and formulas run from an Excel execution engine embedded within the model server. Other third party tools with .NET interfaces can also be loaded and integrated with any model. For development and what-if analysis, the modeler supports "sketch" functions which allow approximations of functions to be visually sketched and used until further analysis or empirical data is available.

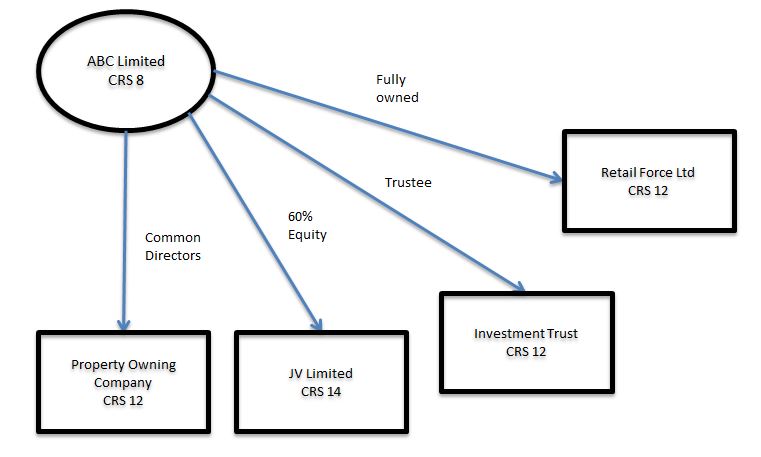

Powerful yet simple borrower group logic

A challenge unique to commercial lending that distinguishes it from retail lending is that the true credit risk of a borrower often depends not only on attributes of the borrower, but also on the relationships that may exist between the borrower and other entities whose assets may potentially be available to secure the credit facility, or affect the borrower's ability to meet loan obligations under different circumstances. These relationships typically include such things as parent-subsidiary relationships between companies, lines of credit or promissory notes, common directors, joint title to assets/obligations under liabilities, associations with trust funds, etc. Furthermore, these relationships may change with time, not only because associations between entities are made and dissolved as entities are merged, acquired, divested, etc., but also because the valuation of the entire ensemble of related assets may change over time. CreditRate(TM) includes a powerful credit rating relationships modeler which allows customer-configured grouping models to be tracked against loans, no matter how complex these relationships become. The risk characteristics of the entire group are automatically updated when when an event occurs that impacts any of the group members. As the group structure evolves over time, CreditRate(TM) will maintain the current group configuration, in addition to historical versions of the group as it evolved.

The CreditRate(TM) deployment roadmap

Using CreditRate(TM) does not require a major, end-to-end systems change-out.

It can easily be initially deployed to integrate with existing systems, using Model Injection(TM) to take over the credit rating functions, and disrupting little else. As the organization travels further down the RFM roadmap, additional RFM modules may be added, building up to the complete RFM Suite(TM), or some subset of it, following a timetable that suits the organization's needs. Our typical deployment roadmap is shown below.

CreditRate(TM) component architecture and workflow diagram

Click to enlarge |

||||||||||||||||||||||

|

Risk Framework Manager

|

|

PRODUCTS & SERVICES

SUPPORT

COMPANY

EVENTS & MEDIA

THOUGHT LEADERSHIP

|

Please send me more information

OK to call me

|

Copyright © 2018 RFM