RFM: The right risk management architecture for financial institutions

|

RFM: The right risk management architecture for financial institutions

|

|

The software collects and analyzes risk-related data from many sources both inside and outside the institution, and uses

this to provide near-real-time visibility into risk at all levels of the organization, from front-line banking, to senior

management, in a way that has never been possible before. For the first time, managers can have up-to-date, accurate

risk-related information and “early warnings” at their fingertips, and run powerful simulations in an intuitive, “drag-and-drop”

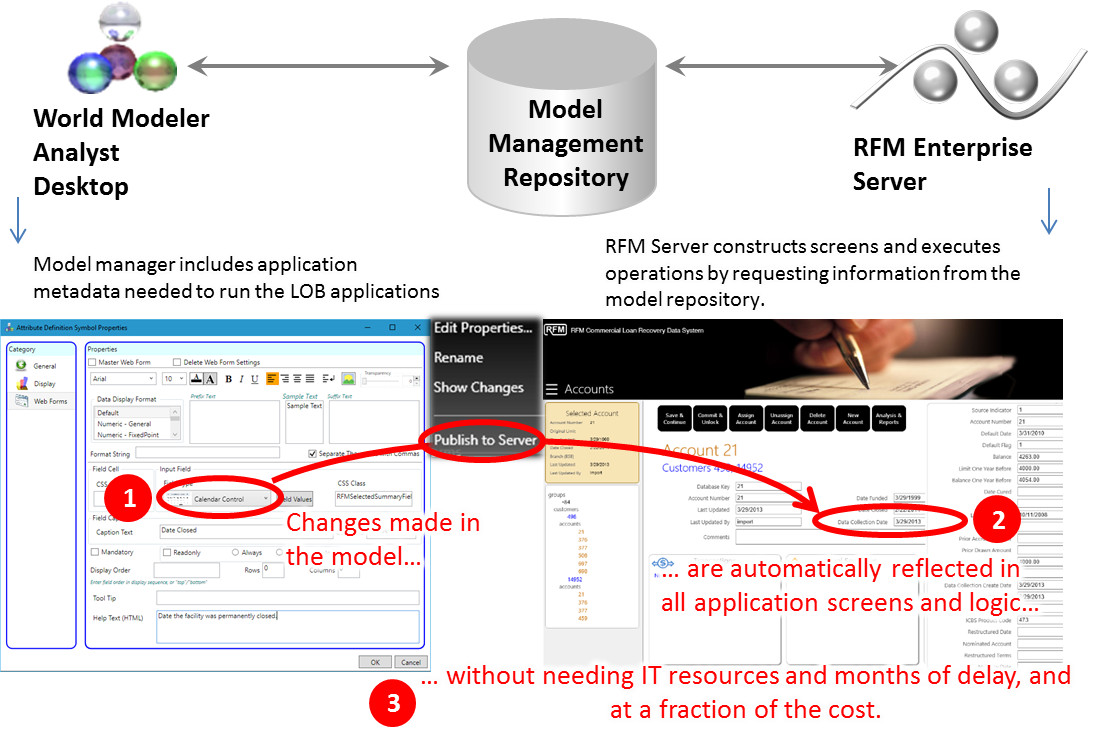

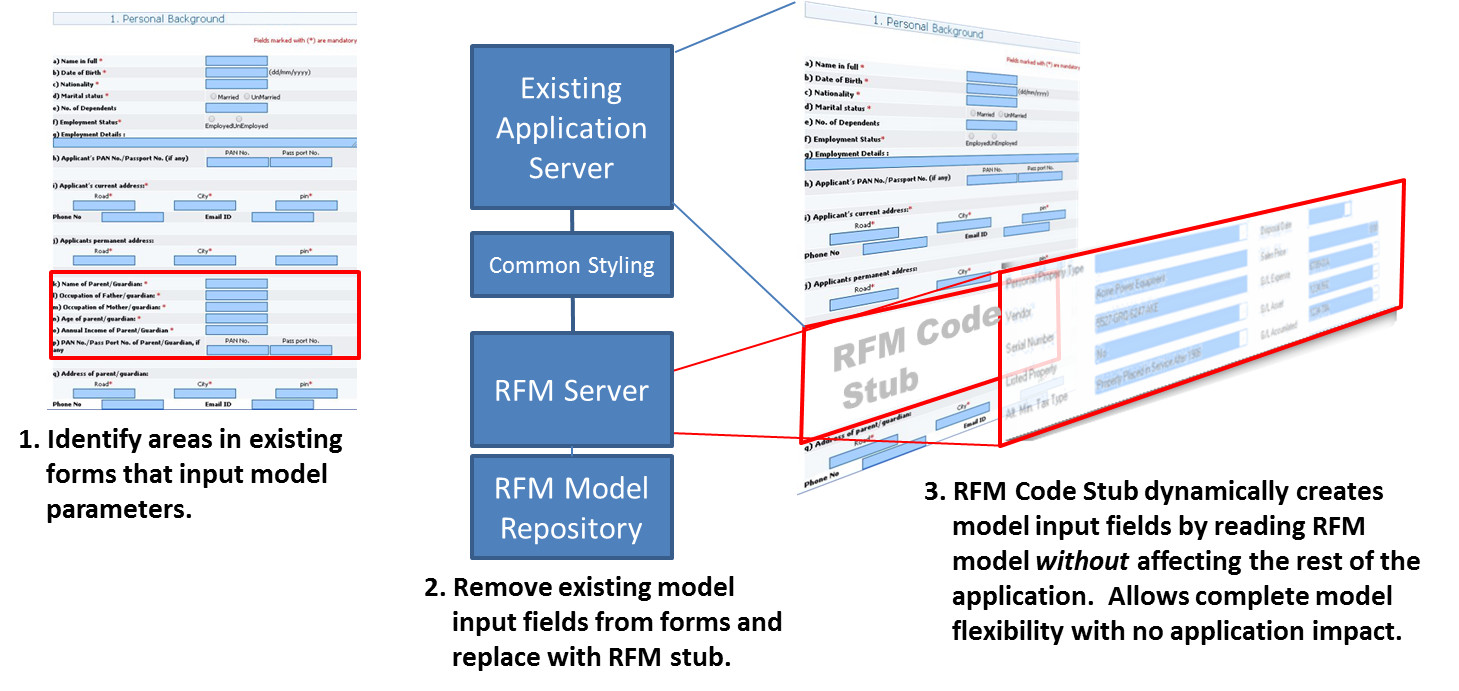

interface. On the “shop floor”, RFM’s unique model-driven metadata architecture slashes go-to-market lead-times due to risk model

updates by automatically propagating these to the business systems that use them, without the months (or years) of IT development

that is typical of today’s practices.

RFM’s modular design, along with its ease of integration, allows it to be deployed on a module-by-module basis, filling the highest

priority gaps in an organization’s risk infrastructure while integrating with what exists, removing the need for wholesale replacement

of existing tools just to take advantage of a few new, key features. The modules include Wholesale Loan Origination, Model Configuration

Management, Probability of Default/Loss Given Default/Exposure at Default models and data management, Regulatory Documentation,

Governance and Oversight, and the Stress Testing Cockpit. Our thought leadership in real-world risk management, data sciences

and software design has produced a number of breakthroughs in “bank-tech”, including the following:

The software collects and analyzes risk-related data from many sources both inside and outside the institution, and uses

this to provide near-real-time visibility into risk at all levels of the organization, from front-line banking, to senior

management, in a way that has never been possible before. For the first time, managers can have up-to-date, accurate

risk-related information and “early warnings” at their fingertips, and run powerful simulations in an intuitive, “drag-and-drop”

interface. On the “shop floor”, RFM’s unique model-driven metadata architecture slashes go-to-market lead-times due to risk model

updates by automatically propagating these to the business systems that use them, without the months (or years) of IT development

that is typical of today’s practices.

RFM’s modular design, along with its ease of integration, allows it to be deployed on a module-by-module basis, filling the highest

priority gaps in an organization’s risk infrastructure while integrating with what exists, removing the need for wholesale replacement

of existing tools just to take advantage of a few new, key features. The modules include Wholesale Loan Origination, Model Configuration

Management, Probability of Default/Loss Given Default/Exposure at Default models and data management, Regulatory Documentation,

Governance and Oversight, and the Stress Testing Cockpit. Our thought leadership in real-world risk management, data sciences

and software design has produced a number of breakthroughs in “bank-tech”, including the following:

|

|

|

Risk Framework Manager

|

|

PRODUCTS & SERVICES

SUPPORT

COMPANY

EVENTS & MEDIA

THOUGHT LEADERSHIP

|

Please send me more information

OK to call me

|

Copyright © 2018 RFM